Biometric Payment Market Overview:

The Biometric Payment Market was valued at USD 28.38 billion in 2022, and the industry is projected to witness significant growth over the next decade. By 2032, the market is expected to reach USD 100.3 billion, growing from USD 32.2 billion in 2023. This represents a compound annual growth rate (CAGR) of 13.46% during the forecast period from 2024 to 2032.

Key Market Drivers

Several factors are contributing to the rapid growth of the biometric payment market:

Increased Focus on Payment Security As the number of online transactions and digital payments continues to grow, there has been an increased focus on enhancing security. Biometric payment systems, which leverage unique biological characteristics such as fingerprints, facial recognition, and iris scans, provide a highly secure method of authentication. This reduces the risk of fraud and identity theft, driving the demand for biometric payment solutions across multiple industries.

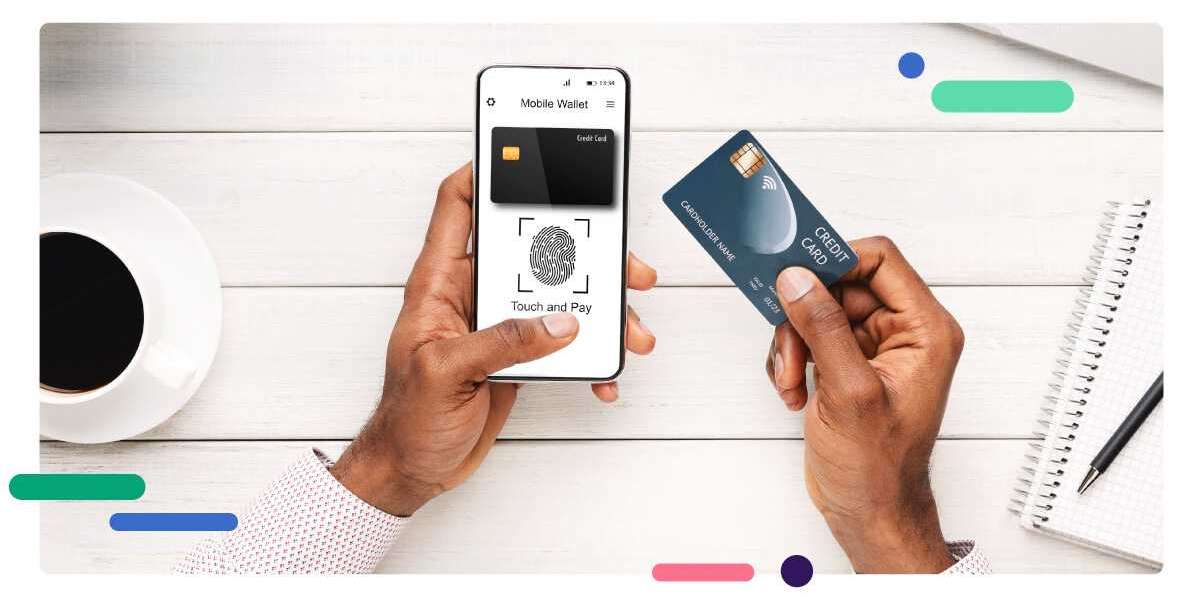

Growing Popularity of Contactless Payments The shift toward contactless payments, accelerated by the global pandemic, has boosted the adoption of biometric authentication systems. Consumers and businesses alike are seeking faster, more convenient, and safer payment methods. Biometric payment solutions enable seamless transactions without the need for physical contact, reducing health risks while improving user convenience.

Expansion of Digital Banking and E-commerce The expansion of digital banking and the rapid growth of e-commerce are also major factors driving the biometric payment market. Digital banking platforms and online retailers are increasingly adopting biometric solutions to enhance the user experience and build customer trust. This growing trend is expected to continue as more businesses look to integrate biometrics into their payment processes, making it easier for consumers to conduct secure online transactions.

Government Initiatives and Regulations Governments and regulatory bodies worldwide are implementing stricter guidelines to enhance security in financial transactions, which is accelerating the adoption of biometric payment solutions. Various countries are encouraging the use of biometric authentication for identification and financial services to prevent fraud and improve transparency. These initiatives are further driving market growth.

Sample Report Request PDF - https://www.marketresearchfuture.com/sample_request/24732

Market Segmentation

The biometric payment market is segmented based on several factors:

By Technology The most commonly used biometric payment technologies include fingerprint recognition, facial recognition, iris recognition, and voice recognition. Fingerprint-based systems are the most widely adopted due to their ease of use, accuracy, and cost-effectiveness. However, facial recognition technology is gaining popularity, particularly in high-security environments and mobile payments.

By Application The market's applications are segmented across banking and financial services, retail, e-commerce, healthcare, and government sectors. The banking and financial services sector leads the market due to the increasing need for secure authentication methods in digital banking transactions. The retail and e-commerce sectors are also significant contributors, as biometric payments streamline the checkout process and enhance customer convenience.

By Region The biometric payment market is witnessing strong demand across North America, Europe, Asia-Pacific, and Latin America. North America holds the largest market share due to the widespread adoption of advanced payment technologies and the presence of major market players. Asia-Pacific is expected to experience the fastest growth during the forecast period, driven by rapid digitalization, increased smartphone penetration, and growing demand for secure payment solutions in emerging economies such as China and India.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the future of the biometric payment market. Innovations in artificial intelligence (AI), machine learning (ML), and cloud-based biometric authentication systems are enhancing the accuracy, speed, and reliability of biometric payment solutions. AI and ML technologies enable real-time fraud detection and improve the overall efficiency of biometric authentication processes.

Additionally, multi-modal biometric systems, which combine multiple biometric features (e.g., fingerprint and facial recognition), are gaining traction. These systems provide enhanced security by requiring more than one form of biometric data for authentication, making it more difficult for fraudsters to bypass security measures.

Challenges

While the biometric payment market is poised for significant growth, there are several challenges that could hinder its expansion:

High Implementation Costs Implementing biometric payment systems can be costly, particularly for small and medium-sized businesses (SMBs). The initial setup costs for biometric hardware, software, and integration can be prohibitive for businesses with limited budgets. However, as technology advances and becomes more widely adopted, these costs are expected to decrease over time.

Privacy Concerns The collection and storage of biometric data raise concerns about privacy and data security. Consumers may be hesitant to share their biometric information with businesses or financial institutions due to fears of data breaches or misuse. To address these concerns, companies need to implement robust data protection measures and adhere to strict privacy regulations to gain customer trust.

Technical Challenges While biometric payment systems offer enhanced security, they are not immune to technical issues. Factors such as poor lighting, facial obstructions, or dirty fingerprint sensors can affect the accuracy of biometric authentication, leading to failed transactions. Ensuring that biometric systems can function effectively in various environments remains a challenge for developers.

Future Outlook

The future of the biometric payment market looks promising, with rapid advancements in technology and increasing consumer demand for secure and convenient payment solutions. As businesses continue to invest in improving payment security, biometric authentication is expected to become more prevalent across industries. The adoption of biometric payments is likely to accelerate further as governments and regulatory bodies implement stricter security standards for financial transactions.

Conclusion

The biometric payment market is expected to experience significant growth, reaching USD 100.3 billion by 2032 with a CAGR of 13.46% during the forecast period. The rising demand for secure payment methods, the expansion of digital banking and e-commerce, and technological advancements in biometric authentication systems are driving this growth. While challenges such as high implementation costs and privacy concerns remain, the overall market outlook is positive as more businesses and consumers embrace biometric payment solutions for enhanced security and convenience.