"Crypto Asset Management Market – Industry Trends and Forecast to 2029

Global Crypto Asset Management Market, By Solution (Custodian Solution, Wallet Management), Deployment (Cloud, On-Premises), Mobile Operating System (iOS, Android), Application (Web-Based, Mobile), End User (Individual, Enterprise), Enterprise Vertical (Institutions, Retail and E-Commerce, Healthcare, Travel and Hospitality, Others) – Industry Trends and Forecast to 2029.

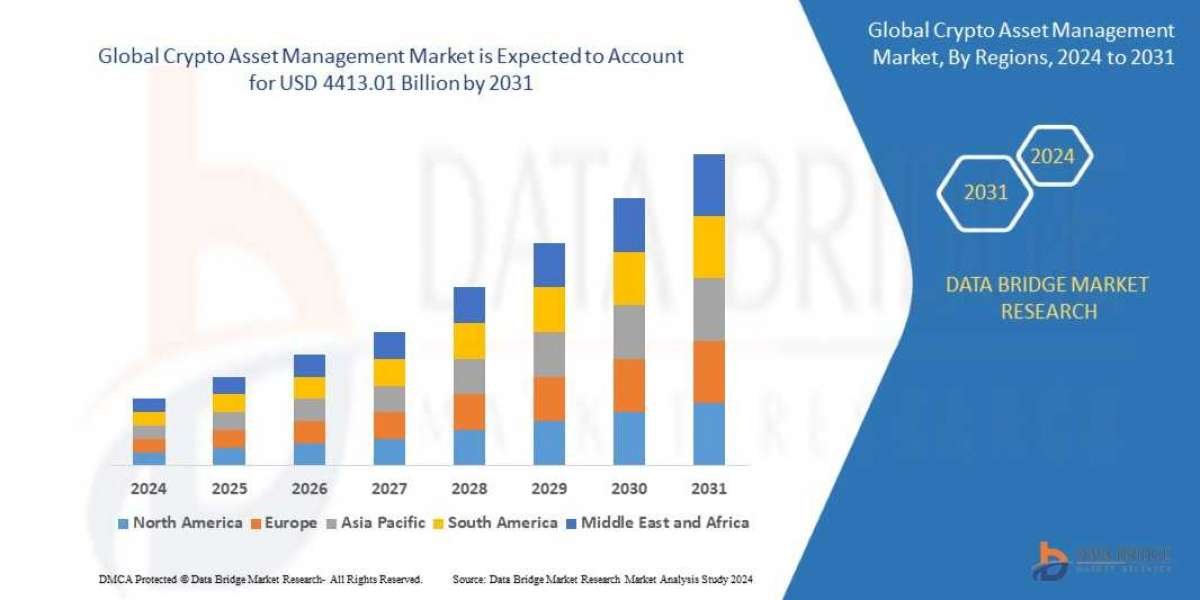

Global crypto asset management market size was valued at USD 717.11 million in 2023 and is projected to reach USD 4413.01 million by 2031, with a CAGR of 25.50% during the forecast period of 2024 to 2031.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-crypto-asset-management-market

**Segments**

The Crypto Asset Management Market can be segmented based on the type of solution, deployment mode, organization size, and end-user. In terms of solutions, the market can be divided into custodian solution, wallet management, tokenization, and others. Custodian solutions involve safekeeping of digital assets, ensuring secure storage and management. Wallet management solutions focus on managing crypto wallets, providing functionalities for easy transactions and monitoring. Tokenization solutions deal with converting real-world assets into digital tokens for trading and investment purposes. The 'others' category may include services like fund management, compliance, and reporting tools.

Deployment modes in the market include on-premises and cloud-based solutions. On-premises solutions offer dedicated infrastructure for managing crypto assets within the organization's premises, providing more control and security. Cloud-based solutions, on the other hand, offer flexibility, scalability, and accessibility from anywhere with an internet connection. Organizations can choose the deployment mode based on their security requirements, IT infrastructure, and budget considerations.

Based on organization size, the market can be segmented into small and medium-sized enterprises (SMEs) and large enterprises. SMEs may opt for cost-effective solutions that cater to their specific needs and budget constraints. Large enterprises, on the other hand, may require more robust and scalable solutions to manage a larger volume of crypto assets and transactions.

End-users of crypto asset management solutions include institutional investors, retail investors, and others. Institutional investors such as hedge funds, asset managers, and financial institutions are increasingly entering the crypto space, driving the demand for advanced asset management solutions. Retail investors, including individual traders and investors, also seek reliable platforms to manage their crypto holdings effectively.

**Market Players**

- BitGo, Inc.

- Coinbase, Inc.

- Crypto Finance AG

- Digital Asset Custody Company

- Exodus Movement, Inc.

- Gemini Trust Company, LLC

- itBit Trust Company, LLC

- Koine Finance

- Ledger SAS

- Metaco SA

- Vo1t

- Xapo

The global Crypto Asset Management Market is witnessing significant growth due to several key factors. The increasing adoption of cryptocurrencies and blockchain technology across various industries is driving the demand for robust asset management solutions. Institutional investors are entering the crypto space, seeking secure and compliant platforms to manage their digital assets. The growing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs) is also fueling the need for advanced asset management tools.

Moreover, regulatory developments and compliance requirements are shaping the market landscape, with companies focusing on providing solutions that meet industry standards and address security concerns. The integration of artificial intelligence (AI) and machine learning technologies in asset management platforms is enhancing security, automation, and decision-making processes for users.

However, the market faces challenges such as regulatory uncertainties, security risks, and lack of standardization in the crypto industry. Security breaches and hacking incidents have raised concerns among investors, highlighting the importance of robust security measures in asset management solutions. Regulatory changes and compliance requirements vary across regions, posing challenges for companies operating in multiple jurisdictions.

In conclusion, the Crypto Asset Management Market presents lucrative opportunities for players offering innovative solutions to meet the evolving needs of investors and institutions in the digital asset space. By focusing on security, compliance, and technological advancements, market players can capitalize on the growing demand for reliable and efficient crypto asset management services.

https://www.databridgemarketresearch.com/reports/global-crypto-asset-management-market

The Crypto Asset Management market research report displays a comprehensive study on production capacity, consumption, import and export for all the major regions across the globe. The target audience considered for this market study mainly consists of Key consulting companies advisors, Large, medium, and small-sized enterprises, Venture capitalists, Value-added resellers (VARs), Third-party knowledge providers, Investment bankers, and Investors. This global market analysis report is the believable source for gaining the market research that will exponentially accelerate the business growth. The top notch Crypto Asset Management market report is the best option to acquire a professional in-depth study on the current state for the market.

Table of Contents: Crypto Asset Management Market

1 Introduction

2 Global Crypto Asset Management Market Segmentation

3 Executive Summary

4 Premium Insight

5 Market Overview

6 Crypto Asset Management Market, by Product Type

7 Crypto Asset Management Market, by Modality

8 Crypto Asset Management Market, by Type

9 Crypto Asset Management Market, by Mode

10 Crypto Asset Management Market, by End User

12 Crypto Asset Management Market, by Geography

12 Crypto Asset Management Market, Company Landscape

13 Swot Analysis

14 Company Profiles

Countries Studied:

- North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

- Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

- Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

- Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Browse Trending Reports:

Streptococcus Infection Market

Renal Panel Testing Market

Form Fill Seal Ffs Films Market

Grant Management Software Market

Omega 8 Pufa Market

Specialty Nitrile Butadiene Rubber Market

Protein In Infant Formula Market

Electric Orthopedic Screwdriver Market

Sodium Benzoate Market

Aloe Vera Juice Market

Digital Photo Frames Market

Cosmetic Bottle Market

Silage Inoculants And Enzymes Market

Multihead Weighers Market

Food Additives Market

Amino Acids Based Biostimulants Market

Outdoor Living Products Market

Diagnostic Reagents Market

Grain Protectants Market

Multiplex Testing Market

Vehicle Tracking System Market

Hematopoietic Agents Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975