The ammonia industry capex plays a critical role in global agriculture, energy, and industrial applications. As one of the primary chemicals used in fertilizers, ammonia is essential for feeding the world’s growing population. With the growing demand for sustainable practices, technological advancements, and global supply chain shifts, the capital expenditures (CapEx) in the ammonia sector have been on the rise.

Buy the Full Report for More Insights on Ammonia Capacity and Capex Market Forecast

Download a Free Report Sample

Key Drivers of CapEx Growth in the Ammonia Industry

Increasing Demand for Fertilizers: Ammonia is the backbone of nitrogen-based fertilizers, which are critical to global food production. With the world population expected to surpass 9 billion by 2050, demand for fertilizers—especially ammonia—is projected to rise. This increased demand is prompting ammonia producers to invest in new production facilities and technology upgrades to meet the growing need for fertilizers.

Technological Advancements: The ammonia industry is seeing significant investments in technology aimed at increasing efficiency and reducing environmental impact. Advances in catalytic processes, such as the development of more energy-efficient Haber-Bosch processes, are reducing production costs and emissions. Furthermore, innovations in green ammonia production—where ammonia is synthesized using renewable energy sources—are attracting significant capital.

Environmental Regulations and Sustainability: Stringent environmental regulations, particularly those targeting greenhouse gas (GHG) emissions, are pushing ammonia producers to invest in more sustainable production methods. Traditional ammonia production via natural gas is energy-intensive and generates large amounts of carbon dioxide. As a result, many companies are exploring options like blue ammonia, which incorporates carbon capture and storage (CCS), or green ammonia, which uses renewable energy. These technologies require substantial CapEx investments.

Geopolitical and Supply Chain Shifts: Recent global events, including disruptions in energy supply chains and geopolitical tensions, have highlighted the need for ammonia producers to diversify their production sources and increase resilience. Investments in new facilities and infrastructure to ensure a stable supply of ammonia have become more critical, driving CapEx growth in the sector.

Rising Fertilizer Prices: The global increase in fertilizer prices, partly driven by rising natural gas costs and supply chain disruptions, is prompting ammonia producers to invest in expanding their production capacity to capitalize on higher profit margins. This is pushing companies to allocate more funds towards enhancing existing plants and developing new ones.

Current Trends Shaping CapEx in the Ammonia Industry

Shift Toward Green and Low-Carbon Ammonia: One of the most significant trends in the ammonia industry is the shift toward green ammonia production. Green ammonia is produced through electrolysis, powered by renewable energy sources, which eliminates CO2 emissions from the traditional ammonia production process. Companies are investing heavily in this technology to align with global sustainability goals and meet environmental regulations. Additionally, blue ammonia, which combines natural gas with CCS technologies, is gaining traction as a more sustainable option.

Infrastructure Expansion: To meet growing demand, ammonia producers are expanding their production and storage facilities. This expansion includes building new plants, upgrading existing ones, and improving distribution networks to reach emerging markets. Investments in ammonia transportation infrastructure, such as pipelines and shipping facilities, are also a part of the ongoing CapEx projects to ensure a reliable supply.

Integration of Automation and AI: The ammonia industry is adopting automation and artificial intelligence (AI) to optimize production efficiency. Investments in AI-driven process control, predictive maintenance, and supply chain optimization are helping ammonia producers reduce costs, enhance productivity, and improve safety. CapEx in automation technologies is expected to increase as companies look for ways to stay competitive.

Decentralized Production Models: To mitigate risks related to supply chain disruptions, many companies are exploring decentralized ammonia production models. Smaller, modular plants located closer to agricultural regions can help reduce transportation costs and improve supply chain resilience. Investments in modular production technologies and local distribution hubs are gaining popularity, especially in emerging markets.

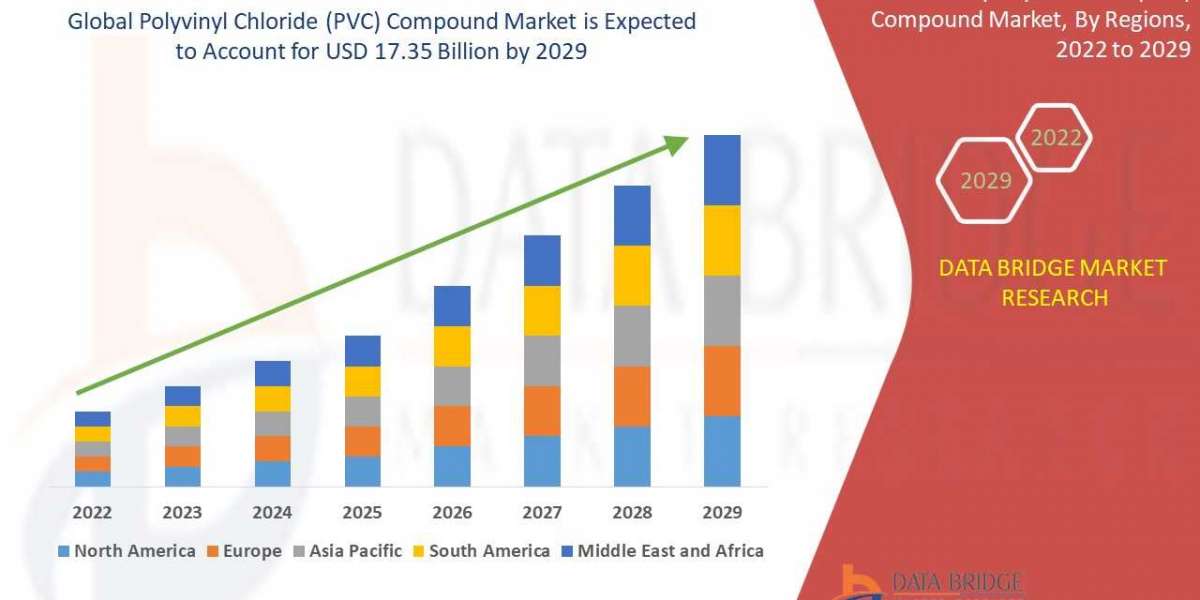

Regional Focus: Where CapEx is Growing the Fastest

North America: The United States is seeing a surge in CapEx in ammonia production due to the availability of natural gas and increasing investment in cleaner ammonia technologies. Major players in the U.S. are exploring blue ammonia production and investing in new plants that comply with evolving environmental standards.

Europe: Europe is at the forefront of developing green ammonia projects, with significant investments in renewable energy-powered ammonia production. The European Union's Green Deal and commitment to carbon neutrality by 2050 are encouraging ammonia producers to invest in low-carbon production methods. Several large-scale green ammonia projects are currently under development across the continent.

Asia-Pacific: The Asia-Pacific region, particularly China and India, is experiencing rapid industrial growth, which is driving demand for ammonia-based fertilizers. Significant CapEx is being directed toward expanding production facilities to meet the needs of the agricultural sector. Additionally, the region is exploring green ammonia technologies, with several projects underway to produce ammonia using renewable energy sources.

Middle East: The Middle East remains a key player in ammonia production due to its abundant natural gas resources. However, the region is also investing in more sustainable ammonia production methods, including blue ammonia projects that use CCS technologies to reduce emissions. As a result, CapEx in the Middle East is growing in both conventional and sustainable ammonia production.