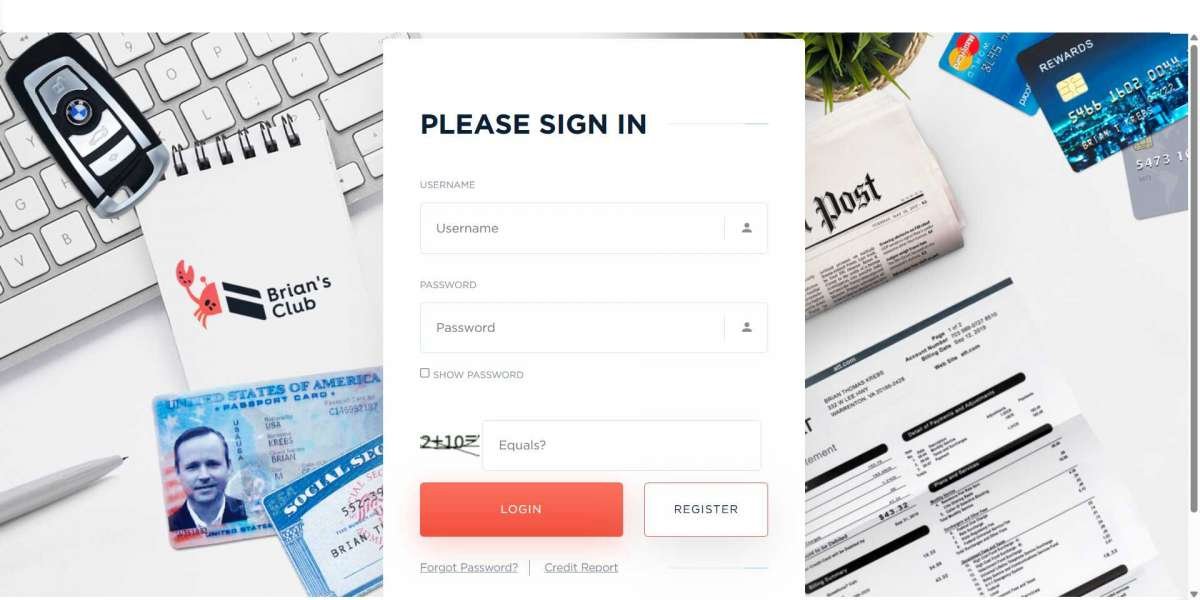

The digital finance landscape is evolving rapidly, and many people are looking for alternative ways to manage transactions. With terms like Bclub, dumps, CVV2 shops, and credit cards appearing frequently in discussions, it’s important to understand what they mean and how they are shaping the online financial world.

What Are Credit Cards, Dumps, and CVV2?

A credit card is a widely used financial tool that allows individuals to make purchases on credit, with repayment required later. These cards come with built-in security features such as a card number, expiration date, and CVV (Card Verification Value) to protect users from fraud.

Dumps refer to the information stored on a credit card’s magnetic stripe. This data is crucial for transaction processing and can include details like the card number and expiration date. While dumps are essential for legitimate financial systems, they have also become a topic of interest in various online communities.

CVV2 is an additional security feature found on the back of a credit card. It is commonly required for online transactions to confirm that the person making a purchase physically possesses the card. CVV2 codes play a vital role in reducing fraud and unauthorized transactions.

How Does Bclub Fit Into This Digital Space?

Bclub is often associated with conversations about dumps, CVV2 shops, and credit cards. As the digital financial world continues to grow, people are looking for faster and more efficient transaction methods. Many traditional banking systems involve multiple verification steps that can sometimes be time-consuming. This has led to the rise of alternative platforms that promise greater accessibility and convenience.

While some individuals explore these platforms for financial transactions, others approach them with caution. In any online space dealing with financial data, trust and security are key factors that users must consider.

Tips to Stay Safe in the Digital Financial World

As digital transactions become more popular, prioritizing security is essential. Here are a few steps to help keep your financial information safe:

Always research and verify the credibility of any financial platform before using it.

Be cautious when entering credit card details on unfamiliar websites.

Regularly monitor your bank statements for any unauthorized transactions.

Enable two-factor authentication for an extra layer of security.

Final Thoughts

The financial landscape is evolving, and platforms like Bclub are part of this transformation. Whether using traditional banking methods or exploring digital alternatives, staying informed and prioritizing security is crucial. As technology advances, making smart and secure financial decisions will always be the best strategy.