Payroll errors can cause significant problems for businesses, leading to unhappy employees, compliance issues, and financial losses. Ensuring accurate and timely payments is crucial, and that’s where a paycheck creator plays a vital role. A paycheck creator helps automate payroll calculations, reducing mistakes and streamlining the process. This article will explore how paycheck creators help businesses prevent payroll errors and manage payroll efficiently.

Understanding Payroll Errors

Before diving into the benefits of using a paycheck creator, it’s important to understand the most common payroll errors businesses face:

Incorrect Tax Deductions: Miscalculating federal, state, and local taxes can result in penalties and compliance issues.

Miscalculated Overtime: Failing to account for overtime properly can lead to underpaying employees, which may cause legal problems.

Delayed Payments: Late payments can reduce employee trust and morale.

Misclassified Employees: Incorrectly classifying employees as independent contractors or vice versa can lead to tax complications.

Errors in Salary and Hourly Wages: Simple miscalculations in hourly pay or salary structures can cause payroll disputes.

A paycheck creator helps businesses eliminate these errors and ensures smooth payroll processing.

What is a Paycheck Creator?

A paycheck creator is an online tool or software that automates payroll calculations, generates accurate pay stubs, and ensures compliance with tax laws. It allows businesses to input salary details, deductions, and taxes to create paychecks instantly. Many paycheck creators offer free versions, making them accessible to small businesses and freelancers.

Key Features of a Paycheck Creator

Automated Payroll Calculations – Eliminates manual errors by calculating salaries, deductions, and taxes automatically.

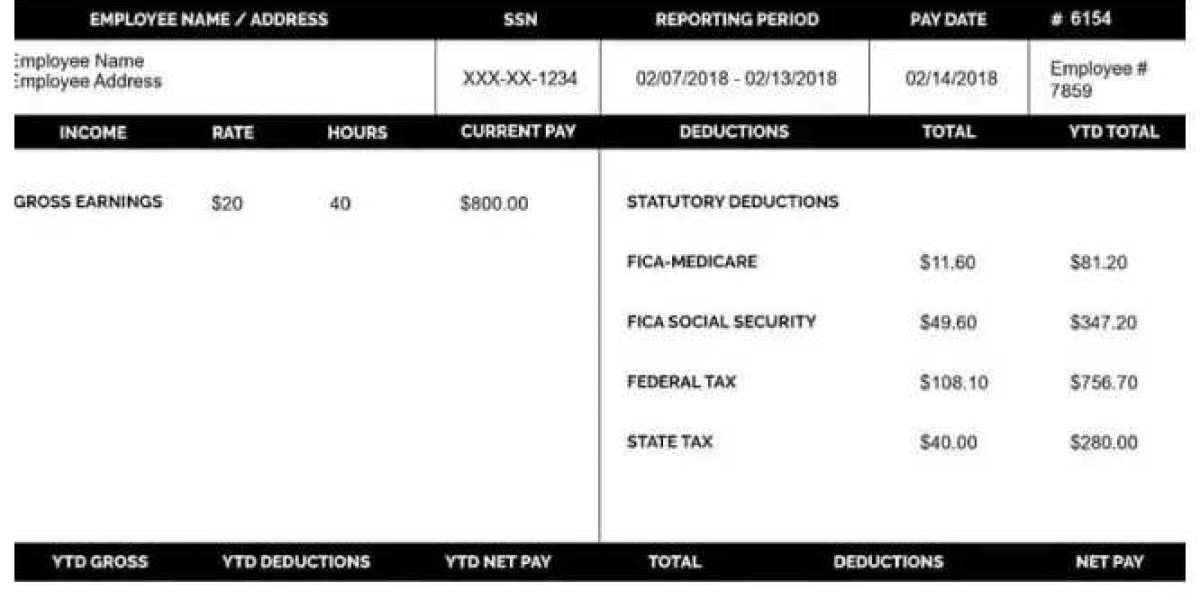

Customizable Pay Stubs – Allows businesses to generate professional pay stubs with company details.

Tax Compliance – Ensures accurate tax deductions to prevent IRS penalties.

Instant Paycheck Generation – Provides pay stubs immediately, reducing processing time.

Record-Keeping – Maintains payroll history for easy reference during audits or disputes.

How a Paycheck Creator Reduces Payroll Errors

1. Ensures Accurate Tax Deductions

One of the biggest challenges in payroll processing is calculating taxes correctly. A paycheck creator automatically applies the correct tax rates based on federal and state laws, preventing costly tax errors. It also adjusts deductions for benefits, social security, and other withholdings.

2. Eliminates Human Calculation Mistakes

Manual payroll calculations increase the risk of human errors, such as misplacing decimal points or miscalculating hours worked. A paycheck creator automates the process, ensuring every paycheck is calculated accurately.

3. Provides Clear Payroll Records

Maintaining detailed payroll records is essential for audits, tax filings, and employee disputes. A paycheck creator stores payroll history and allows businesses to generate reports instantly, reducing confusion and mistakes.

4. Automates Overtime and Bonus Calculations

Miscalculating overtime pay can lead to underpayment issues. A paycheck creator includes overtime calculations based on company policies and labor laws, ensuring employees receive the correct compensation.

5. Reduces Payroll Processing Time

Processing payroll manually is time-consuming, especially for businesses with multiple employees. A paycheck creator speeds up the process by handling calculations automatically, freeing up time for HR and finance teams.

6. Minimizes Classification Errors

Classifying employees incorrectly can lead to tax and compliance issues. A paycheck creator provides clear distinctions between full-time employees, part-time workers, and independent contractors, ensuring accurate payroll processing.

Benefits of Using a Paycheck Creator for Small Businesses and Freelancers

1. Cost-Effective Payroll Management

Small businesses and freelancers often cannot afford expensive payroll services. A paycheck creator offers an affordable solution, with many tools available for free or at low cost.

2. Simplifies Payroll for Freelancers and Gig Workers

Freelancers and gig workers need to track their earnings and deductions accurately. A paycheck creator helps them generate pay stubs for financial tracking and tax filing.

3. Enhances Employee Satisfaction

Employees rely on accurate and timely paychecks. Using a paycheck creator ensures they receive their correct wages on time, boosting trust and satisfaction.

4. Improves Compliance with Labor Laws

Staying compliant with labor laws is essential for businesses. A paycheck creator helps track deductions, benefits, and tax requirements to prevent legal issues.

Choosing the Right Paycheck Creator

When selecting a paycheck creator, consider the following factors:

Ease of Use: Look for an intuitive interface that simplifies payroll processing.

Tax and Compliance Features: Ensure the tool is updated with the latest tax laws.

Integration with Payment Systems: Some tools integrate with direct deposit or online payment platforms.

Data Security: Payroll information is sensitive, so choose a tool with strong security measures.

Scalability: Select a tool that grows with your business.

How to Use a Paycheck Creator

Using a paycheck creator is simple and requires just a few steps:

Enter Employee Details – Input the employee’s name, pay rate, and payment schedule.

Specify Deductions and Benefits – Include tax deductions, health insurance, and other withholdings.

Generate the Pay Stub – The tool will calculate earnings and generate a pay stub instantly.

Review and Download – Check for accuracy, then download or print the pay stub.

Distribute Pay Stubs – Share with employees digitally or through physical copies.

Common Payroll Mistakes to Avoid

Even with a paycheck creator, businesses should be aware of common payroll mistakes:

Not Updating Tax Rates – Regularly check that tax rates are up to date.

Ignoring Local Tax Laws – State and city taxes may differ; ensure compliance.

Forgetting to Include Benefits – Always factor in employee benefits and deductions.

Delaying Payroll Processing – Stick to a regular payroll schedule to avoid delays.

Not Keeping Payroll Records – Maintain payroll records for future reference and compliance.

Conclusion

Payroll accuracy is crucial for any business, and a paycheck creator helps eliminate errors, saves time, and ensures compliance with tax laws. Whether you’re a small business owner, freelancer, or HR manager, using a paycheck creator simplifies payroll processing, enhances employee satisfaction, and reduces financial risks.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons